During the first term of the Clinton Administration in the early 1990’s, a phrase became popular in the financial press. Whenever interest rates increased, the media and Wall Street discussed and coined the phrase: “The Bond Market Vigilantes.” As the federal government debated tax policy and federal spending, any time a proposal was put forth that would increase the deficit, interest rates would quickly increase, ostensibly threatening to slow the economy. The fixed- income traders who drove these interest rate increases became known as “Bond Market Vigilantes” and essentially forced budget discipline upon the federal government.

Those debates over the size of the debt now seem quaint by comparison. At the end of 1995, the federal debt totaled just under $5 trillion. According to the New York Times[1]., the gross national debt passed $33 trillion on September 17th of this year.

Since 2000 (the last time the US government ran a budget surplus), the federal debt has ballooned. In response to a variety of crises, from the 9/11 terrorist attacks to wars in Iraq and Afghanistan, the financial recession of 2008-2009 and the Covid pandemic, the US government has engaged in massive deficit spending and kept interest rates exceptionally low for most of the past 20 years.

However, the days of ultra-low interest have ended, at least for now. The US Federal Reserve began a campaign of interest rate increases early in 2022 to combat inflation, which had risen to over 9%. Over an 18-month period, the Federal Reserve raised short-term rates from basically 0% to over 5%. For much of that time, longer-term rates remained subdued and

did not increase as much as short-term rates. This is a reminder that while the Fed can set short-term rates, the market determines longer-term rates.

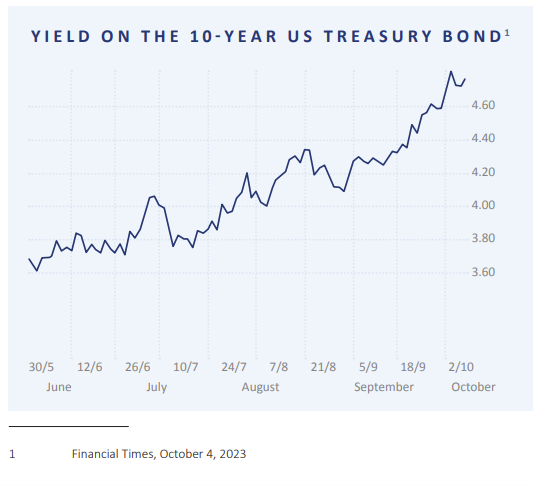

Arguably, one of the largest financial news stories of the third quarter of 2023 has been the rapid increase in long-term interest rates. The yield on the 10-year US Treasury bond is one of the most important interest rates in financial markets. Mortgage rates are based on the 10-year Treasury bond rate, and it is an important benchmark for longer-term bonds as it represents the risk-free rate. On May 31st of this year, the 10-year Treasury yielded 3.60%. On October 2nd, the first trading day of Q4, the yield had increased to 4.80%. Over that same period, the S&P 500 dropped by approximately 6.5% in reaction to the increase in long-term rates.

After a prolonged stretch where short-term rates increased more than longer-term rates, why was there such a dramatic change in the last four months? Several factors contributed to this increase:

- At the beginning of 2023, conventional wisdom suggested that the rapid increase in the Fed Funds rate in 2022 would slow the economy in 2023. Many economists were predicting the Fed would begin to lower rates in the second half of this year. However, the US economy has remained resilient, and GDP has remained markedly positive. GDP grew 2.2% in Q1 and 2.1% in Q2. Early estimates of Q3 are even higher. This resilience in the economy has led investors to believe rates will stay “higher for longer.”

- Inflation has moderated since the highs of June of 2022, when it reached 9.1% as measured by the Consumer Price Index (CPI). September headline CPI data showed that prices increased in the last twelve months by 3.7%, and with the Fed’s target inflation rate at 2%, there is still work needed to curb inflation.

- While inflation remains the current focus of the Federal Reserve, US government debt levels have started to worry the market once again. The recent political turmoil over the debt ceiling was a fresh reminder of the problems with the US budget process as the US ran an additional $1.7 trillion deficit in the fiscal year that ended September 30th. The Treasury must continue to sell more debt to fund this deficit, yet the increase in interest rates also increases the cost of servicing our debt. With the outstanding US debt now totaling $33 trillion, each 1% rise in interest rates increases the annual debt service cost by $330 billion.

Thus, our comments on the return of the Bond Market Vigilantes. Investors are now demanding a higher interest rate to buy bonds from the US government, both because of concerns about US inflation and the overall budget.

The increase in longer-term interest rates has been one key driver of the recent negative performance of the US stock market. Higher long-term rates can hinder the stock market for several reasons:

- It is likely that higher interest rates, both short and long-term, will eventually slow the economy;

- Concerns that inflation may prove long-lasting remain, thus leading to higher rates;

- With higher rates, bonds become a more attractive investment, potentially providing an alternative to stocks or other assets; and

- The US dollar has also rallied in the last few months, due to the rise in rates. A stronger dollar is often a drag on earnings for companies with significant foreign revenue.

Even if the Federal Reserve pauses or stops its campaign to raise short-term rates, two other factors may continue to have an impact on the economy. Those are quantitative tightening and an increase in “real” interest rates.

QUANTITATIVE TIGHTENING

- During the financial crisis in 2008-2009 and again during Covid, the Federal Reserve engaged in a process known as “Quantitative Easing.” This means they purchased existing bonds held by various parties, both Treasury Bonds and Mortgage-Backed Bonds, and held them on their balance sheet. This served two purposes: Inject more cash into the economy and hold down or decrease interest rates by increasing the demand for bonds.

- In September of 2008, the Fed’s balance sheet held about $900 billion in bonds. That grew to about $4.4 trillion by September of 2014. The Fed did start to reduce their balance sheet in 2019, but when the COVID-19 pandemic hit, they again engaged in Quantitative Easing. The Fed balance sheet increased from about $3.8 trillion in late 2019 to a peak of almost $9 trillion in April of 2022.

- The Fed has now started reducing their bond holdings, mostly by letting them mature and collecting the cash. This is known conversely as “Quantitative Tightening,” and takes cash out of the economy, serving as another mechanism to slow the economy and combat inflation.

REAL RATE OF INTEREST

- The real rate of interest is defined as the interest a bond pays minus the rate of inflation. So, if a bond pays a 6% coupon rate and inflation is 2%, the real rate on that bond is 4%. This measures the increase (or decrease) in the purchasing power of the dollar.

- As inflation decreases, even if interest rates stay the same, the real interest rate increases, for example:

6% coupon 4% inflation = 2% real interest rate

6% coupon – 2% inflation= 4% real interest rate

- With inflation coming down, even if the Fed stops increasing the Fed funds interest rate, the real interest rate will climb. This raises real rates without any action by the Federal Reserve, which can also slow the economy, due to higher interest costs to borrowers.

WHAT DOES IT ALL MEAN ?

The US, and most of the world, have been in an extended period of extremely low interest rates. Since 1982, interest rates in the US have mostly trended down. That environment has now changed, and possibly for an extended period of time. With stubborn inflation, a large and increasing federal debt, and a seeming lack of political will to address debt levels, we may be in a “new normal” of higher interest rates, at least as compared to the last three decades.

As we noted, this recent increase in longer-term interest rates has caused increased volatility in the stock market after a strong recovery in the first half of 2023. Higher interest can and eventually will slow down the US economy and could even cause a recession. But it also can provide investors with opportunities, such as:

- Bonds are now a much more interesting asset class than they have been in a long time as investors can get more attractive yields.

- If the economy does slow or even enters a recession, there will inevitably be new investment opportunities that arise. Funds that seek to invest in distressed debt or distressed companies may find ample situations to put money to work in the future with favorable return expectations.

- The yield curve remains inverted, which means short-term rates are higher than long-term rates. Thus, short-term fixed-income investments, such as money market funds or US Treasury Bills, continue to look attractive.

POST – SCRIPT

While much of this market update was written on Friday, October 6th, the next day, news came out about terrorist attacks from the Gaza Strip on Israel and the declaration of war by Israel on Hamas. This is a stark reminder that there are always unexpected geopolitical events that can impact the economy and the markets. We try to build portfolios that will anticipate volatility, not react to it. While it is still too early to know the impact of this latest unrest in the Middle East, Bordeaux Wealth Advisors will continue to watch and assess the impact on your financial plan and investments.

[1] “US National Debt Tops $33 Trillion for First Time”, New York Times, Sep. 18, 2023

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance.

To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: