Market Recap And Commentary

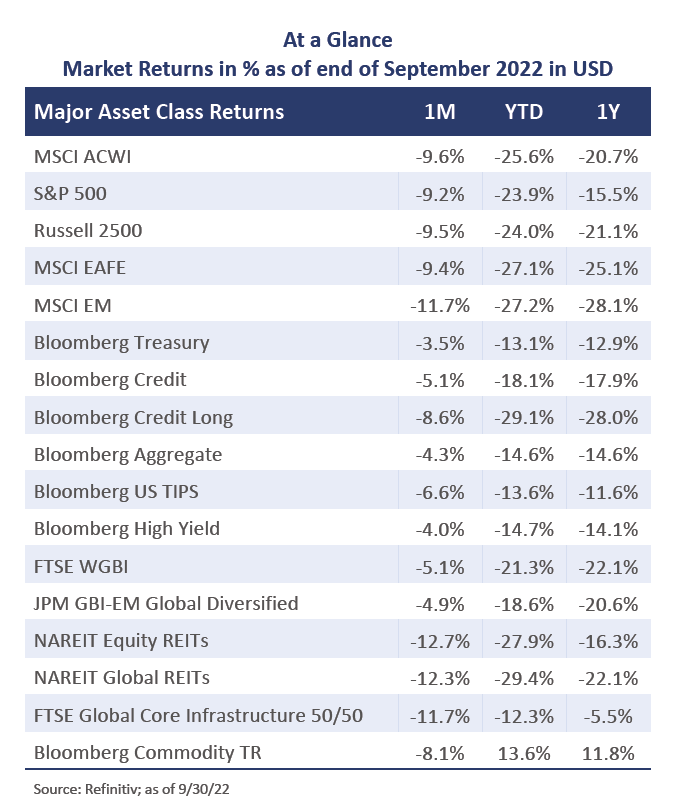

As the third quarter ended, few portfolios were unscathed as a major drawdown affected almost all publicly traded asset classes. Equities sold off across the board, bringing major indices back into bear market territory. Fears of more monetary policy tightening appear to be the primary cause, as inflation continued to surprise to the upside in most countries. The sell-off was broad-based across sectors and regions with emerging market equities faring worse than developed markets. Equity market volatility returned to heights seen in early summer.

Bond returns were also negative after another meaningful rise in yields as central banks in most regions continued to tighten monetary policy, led by the US Federal Reserve hiking interest rates by 75 basis points to levels not seen since 2008. The UK went through a major government bond (i.e., “gilt”) sell-off after its government announced a budget that markets deemed fiscally unsound. The 10-year gilt yield soared by over 130 basis points and ended the month at over 4%, above the equivalent US yield for the first time in eight years. Markets positioned for the Bank of England having to double down on tightening to offset the new Prime Minister’s expansionary budget at a time of record high inflation. Soaring yields led to a scramble for collateral by UK pension plans that often use leverage for liability hedging strategies, with some forced deleveraging by fund vehicles used by UK plans. This ultimately led the Bank of England to provide temporary liquidity support at the longer end of the yield curve to protect the UK pension sector.

Inflation was a major driver of negative market sentiment as much of the world is experiencing levels near a 40-year high. While CPI measures continued to decline from their previous peak, core inflation gained pace, suggesting that inflation momentum remains strong across the global economy. Investors interpreted this as a sign that monetary tightening is likely to continue over the near term.

Geopolitics remained at the forefront of investors’ concerns. Russia suffered major defeats in Ukraine, announced a partial military mobilization, and continued to suggest that further escalation was possible. The Nord Stream pipelines also appear to have been sabotaged further challenging Europe’s access to natural gas in front of the winter months.

As we wrote earlier this summer, the catalysts for the current inflationary environment have been a combination of:

- Extraordinary fiscal and monetary economic support from governments both in the US and globally to support the economy during Covid shutdowns;

- A shortage of goods caused by supply chain issues also resulting from the Covid shutdowns; and

- Turmoil in energy and food markets stemming from the Russian invasion of Ukraine.

These factors have caused a classic inflationary spiral, with too much money chasing too few goods. Coupled with strong wage increases due to low unemployment; the result has been extremely high rates of inflation not seen since the early 1980s.

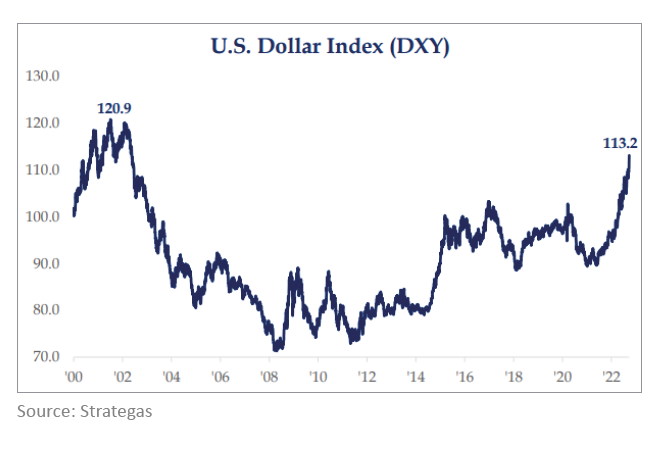

The increase in interest rates in the US has been the catalyst for a rapid appreciation in the value of the dollar versus other global currencies. Recently, the US dollar hit an all-time high against the UK Pound and its highest level against the Euro in 20 years. The strength of the dollar can have both positive and negative impacts on our economy. A stronger dollar makes imports cheaper and is also a factor in the recent decline in oil prices. But it can also drive up the trade deficit as US exports become more expensive. It also negatively impacts the earnings of US corporations that generate significant portions of their revenue internationally when they must translate foreign currencies back to US dollars.

Additionally, many emerging market countries are negatively impacted by a strong dollar. Both governments and companies in these countries are forced to borrow internationally in dollar terms. When their currency depreciates against the dollar, it increases the repayment burden. So, higher interest rates in the US can have a doubly negative impact: Higher cost to borrow because rates have gone up and more difficulty in servicing their debt because their currency depreciates. This is often called the “spillover effect” of interest rates increasing in the US.

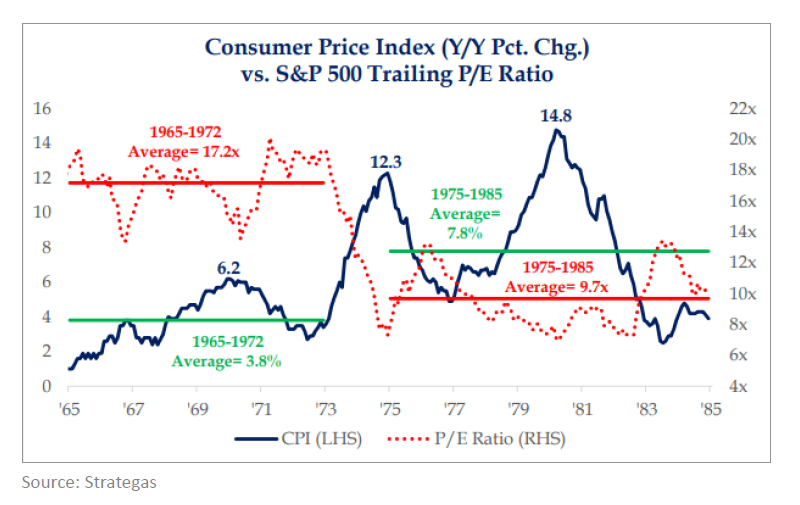

Earnings estimates for US corporations remain elevated going into 2023 and the market is still at risk of a further downturn. In a typical recession, earnings fall 30% on average. With the current trailing P/E just over 15 times, equities have the potential to fall even further based on historical valuation metrics during recessions or in periods of high inflation.

The primary question now driving future markets is: Can the US Federal Reserve engineer a soft landing where it raises interest rates sufficiently to slow inflation without causing a recession, or will they go too far and cause a deep economic downturn? It appears that the Fed is going to proceed with its mandate for price stability regardless of whether investors believe their future actions are right or wrong.

What Should Investors Do Now?

Market and economic turmoil can generate both risks and opportunities. Long-term wealth for investors is often determined by how they react in times of market turmoil. Bordeaux aids clients by helping them mitigate portfolio risks and seek to take advantage of any opportunities. Specifically, here are some considerations we suggest:

- Stay the course and avoid panic selling – Investors often sell in market downturns for two main reasons: First, they do not have enough liquidity for their short-term spending needs, or second, out of fear. As part of our ongoing planning, we always discuss liquidity and spending needs with you and try to make sure you have sufficient liquidity. If liquidity is sufficient, the best way to avoid emotional selling is simply to recognize it. The US economy has been through many recessions and the markets have experienced many downturns. We build portfolios for the long term.

- We develop an asset allocation in anticipation of volatility, not to react to it – A well-designed, diversified portfolio is the single best tool to weather market volatility. We build portfolios by combining assets that react in different ways to economic forces and seek, where possible, uncorrelated assets. In an ultra-low interest rate environment, traditional bonds have been unattractive for the last several years. By investing in areas such as Private Equity, Private Debt, Real Estate, Life Settlement Funds, and Royalties, for example, we have reduced exposure to fixed income while adding assets that help reduce portfolio risk or provide diversified return streams.

- Underlying managers are actively adjusting their portfolios to react to the economic conditions – While you may not see a great deal of activity on the surface when you look at your accounts, the managers we select for you are actively managing their portfolios to adjust to today’s economic conditions. For example, our real estate managers have been transitioning their portfolios away from sectors of the real estate market like offices and shopping malls, and instead investing in multi-family housing, logistics, and warehouse facilities. We are in constant communication with our managers to understand and evaluate how their investment strategies are navigating today’s market environment.

- If you have excess cash to invest, consider dollar cost averaging into asset classes where you are below your Strategic Asset Allocation target – Market turmoil often produces terrific buying opportunities. But there is also increased risk in trying to time when to jump into the market. If you have cash that you are willing to invest for the long term, we suggest dollar cost averaging into the parts of your Strategic Asset Allocation that may be the most volatile. This helps you avoid picking the wrong time to invest and spreads out purchases over several months and at differing price levels.

- Bonds are becoming more attractive – After extremely low-interest rates for many years, higher interest rates have made bonds more attractive. One of our Municipal Bond managers reports that yields on short-term investment-grade municipal bonds now range from 3.15% − 3.25% or a tax-equivalent yield of 5.25% − 5.50% for investors in the highest federal income tax bracket. For investors in high-tax states like California, buying municipal bonds issued in California can increase the tax-equivalent yields even further.

- Take advantage of tax planning opportunities – Equity market declines can present tax planning opportunities. We routinely engage in tax-loss harvesting to sell securities that have declined in value to capture the capital loss. However, additional tax planning opportunities could include Roth IRA conversions where the IRA assets are at a temporarily depressed value or gifting assets to family members to remove them from your estate when their values are lower than in the recent past.

- Recognize that your knowledge and understanding of today is based on the past yet future decisions are made in the face of uncertainty. There is no shortage of market commentators offering predictions on what will happen with the economy and inflation next year. The historical record shows, however, that most of these predictions will be wrong. The behavior of markets, the emotions of investors, and the performance of the global economy does deviate materially from past patterns – and thus most forecasts rarely turn out to be accurate. We understand this and seek to control the emotional decisions of investors in times of uncertainty and instead focus on those items we can control.

Thank you for your trust and confidence. All of us at Bordeaux Wealth Advisors welcome the chance to discuss any issues or concerns you have regarding your family’s financial position.

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: