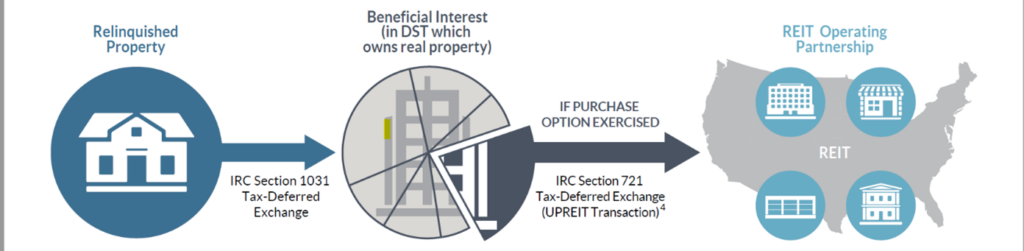

Sections 1031 and 721 provide investors who own appreciated real estate the opportunity to sell their property and exchange it on a tax-deferred basis for interests in a diversified property portfolio of a Real Estate Investment Trust (REIT).

This exchange process may provide an opportunity for investors who:

- Own real estate with significant built-in gains

- Are hesitant to sell because of high tax consequences and would like to recognize the capital gain over time or at a future date

- Have depreciated their real estate over many years, further increasing their tax consequences at sale

- Are tired of actively managing their investment property

- Are looking to utilize an estate or tax planning strategy

- Desire or could benefit from diversification

How it works:

- A diversified REIT contributes a single institutional property from its portfolio to a Delaware Statutory Trust (DST)

- Clients sell their property (single asset or even multiple properties) and complete a traditional Section 1031 like-kind exchange by identifying the property held by the DST

- After a statutory period of time (typically 2 years), the REIT reacquires the DST property in an UPREIT transaction intended to be tax-deferred under Section 721, ultimately offering the client operating partnership units of the diversified REIT (in the form of limited partnership interests in the privately held REIT)

Potential investor benefits offered by Operating Partnership (OP) units:

- Deferral of capital gain tax from your original property sale

- Access to a diversified portfolio of institutional quality real estate assets

- Potential capital appreciation and current income from the REIT’s underlying real estate holdings

- Divisibility of OP units for estate planning purposes

- Potential liquidity and management of taxable gain via a redemption of OP units over time

- Step-up in cost basis of the remaining OP units held at the death of the owner, potentially creating a permanent tax deferral for beneficiaries

To learn more about this exchange process, contact your BWA service team or your tax advisor. You can also visit www.bordeauxweathadvisors.com

Important Disclosures

The material for this article was gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of the information, and certain information presented here may have been condensed or summarized from its original source. This article is not intended to provide tax or legal advice, and nothing contained in these materials should be taken as such. To determine which strategies may be appropriate for you, consult your tax and financial professionals. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: