Assessing the Current Economic Environment

As we approach the end of the second quarter of 2022, many observers are concerned that the US economy is headed for a recession as the Federal Reserve steps up its actions to fight inflation. High energy prices, the highest inflation numbers in forty years, and a coordinated campaign of interest rate increases by central banks worldwide seem to be slowing the global economy. Capital markets have reacted to higher interest rates and the prospect of a slowing economy by experiencing one of the worst starts to a year in decades. Both stock and bond markets have experienced significant declines to start 2022.

However, we think it is important to put these declines in perspective compared to market performance over the last two and a half years. Below is a comparison of where markets closed on January 3rd, 2020, right before the Covid pandemic hit, and where they closed on Thursday, June 16th, 2022:

| 1/3/2020 | 6/16/2022 | % Increase | |

| S&P 500 | 3235 | 3667 | 13.3% |

| DJIA | 28634 | 29927 | 4.5% |

| NASDAQ | 9007 | 10646 | 18.2% |

| Yield on 10-year US Treasury | 1.80% | 3.195% |

Stock market levels have declined but are still 13% (S&P 500) to 18% (NASDAQ) higher than they were at the beginning of 2020. While interest rates have increased, most of that increase has been in the last two months. In reality, markets are now giving back gains that were fueled by extraordinary interventions by the Federal Reserve and the Federal Government in response to the Covid shutdowns. The Federal Reserve slashed interest rates to near zero and engaged in trillions of dollars of quantitative easing, essentially printing money. Simultaneously, the US government spent trillions of dollars to support the economy during the Covid shutdowns.

All of this may have been justified in reaction to a global pandemic, but it undoubtedly set the stage for an inflationary spiral. The Covid shutdown constrained the supply of many goods globally, but at the same time, there was a huge surplus of money created to avert an economic meltdown. A shortage of workers has pushed up wages as recently there have been two job openings for every person looking for work. So, the economy had more money chasing fewer goods, which is a recipe for inflation. The Russian invasion of Ukraine and the resulting increase in energy and food prices exacerbated the inflation problem.

All of this has resulted in the highest inflation in 40 years, not only in the US but across much of the world. The Federal Reserve has arguably been behind the curve in recognizing the threat of inflation but is now moving aggressively. On June 15th, they raised the Fed Funds rate by .75%, the biggest increase since 1994. Worries about inflation and actions by the Fed have pushed up interest rates across the economy. The 10-year Treasury has recently been as high as 3.4%, and mortgage rates have risen dramatically, with the 30-year fixed mortgage rate exceeding 6%. Also, rapid increases in interest rates, from an exceptionally low starting level, have caused bond prices to decline dramatically. Investors usually look to bonds as protection against downturns in the stock market, but they have offered no protection this time as bond prices are down sharply.

All of this does not mean a recession is a certainty. The unemployment rate is still historically low, corporate profits are still strong, and most businesses are operating at or close to full capacity. However, whenever central banks have aggressively increased interest rates to combat inflation, as they are now across the globe, recessions have often been the result. Some economists have estimated there is a 50% chance that a recession may start later this year or next. As a result, many companies are beginning to make contingency plans for a recession, and some industries, especially technology, have started to announce layoffs. These actions can sometimes become self-fulfilling and lead to a recession.

We also need to recognize that some issues are beyond the Federal Reserve’s control. The Russian invasion of Ukraine and its impact on both energy and food prices will continue to have inflationary impacts across the globe, regardless of interest rates. Both the Russian invasion and heightened tensions with China have many observers predicting that the era of globalization and unbridled global free trade is over. Globalization has been one of the primary reasons that inflation has been so remarkably low over the last 20+ years. Structural changes in the global economy may mean lower economic growth and higher inflation in the coming years.

What Should You Do Now?

Headlines about market “crashes” and runaway inflation make great news stories, but they also create fear, uncertainty, and doubt for investors. Economic recessions create real pain for people. However, recessions are part of the normal business cycle and can provide valuable, albeit painful in the short-term, benefits. Excesses from long expansions get wiped away and can provide fresh investment opportunities. We recognize there has been real pain in both the equity and bond markets and do not want to minimize that fact. However, recessions are an inevitable part of the economic cycle and investing, and we must avoid the temptation of making emotional short-term investment decisions that usually make matters worse.

When markets become volatile, two reactions can cause permanent capital loss when investors react to short-term information or events. The first is forced selling because of a lack of short-term liquidity to cover living needs. The second is selling based on the emotions of the moment.

The best way to avoid forced selling for liquidity needs is by Implementing a cash flow plan and/or maintaining a cash balance to sustain your lifestyle for a year or even two, with reserves for emergencies. This “sleep well” comfort will help avoid forced selling and permanent loss of capital.

The best way to avoid the risk of selling based on emotion can be simply recognizing the phenomenon. If an investor has sufficient short-term liquidity and a well-constructed asset allocation, they should be able to weather the temporary volatility of the markets. The panic instinct to sell to avoid further losses is understandable given human nature, but understanding those emotions and working with professional advisors can help overcome emotional responses and prevent you from trading on those emotions.

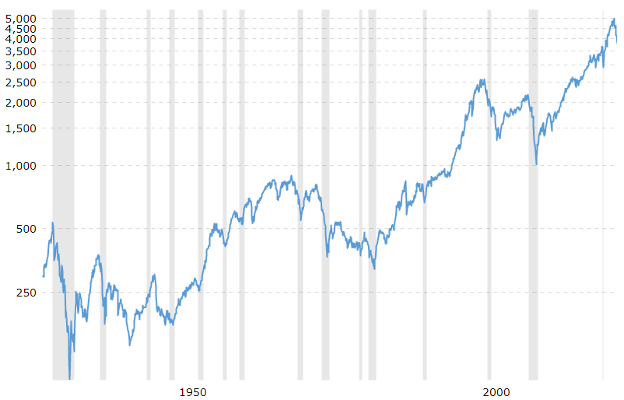

The most important reminder that we tell clients is to have a long-term view. Our focus for planning and investing is always the long-term. The chart below shows the S&P 500 over the last 95 years. The shaded sections are recessions. The stock market usually drops when recessions begin as corporate earnings decline. However, this chart also shows that the stock market recovered after every recession as the economy resumed growth and corporate earnings recovered.

S&P 500 Monthly Closing Values January 1927-May 2022

Source: macrotrends.net/2324/sp-500-historical-chart-data

While we watch and wait for the economy and markets to recover, there are several things you and we can do to protect against losses and limit the damage of a market decline:

- Monitor your liquidity It is always prudent to have sufficient liquid assets available for expenses so you are not forced to sell longer-term assets at a loss when the market is down. Selling when the market is down will lock in losses and adds the risk of being out of the market when it rebounds.

- The market may well get worse before it gets better Be mentally prepared that the market may go down more, but all the steps we have taken in long-term planning and portfolio construction will help you get through a difficult market.

- An asset allocation that fits your long-term goals is still one of the best ways to manage risk. Stick to your model allocation, and do not be afraid to rebalance to asset classes that have declined below the target.

- Finally, harvesting capital losses in taxable accounts allows one to generate tax benefits. Tax loss harvesting is the process where you sell positions that are at a loss while simultaneously buying securities with similar behavior that will maintain your asset allocation and your market exposure so you are not whipsawed by short-term market movements.

We deeply appreciate your trust and confidence in Bordeaux Wealth Advisors. We function as fiduciaries, with your best interests in mind at all times. We will continue to collaborate with you and provide investment recommendations that take into consideration your goals while balancing the appropriate tradeoff between risk and return. We always take into consideration your risk profile, return objectives, cash flow needs, liquidity preferences, time horizon, and tax status.

We are happy to discuss your concerns and answer any of your questions at any time. Please reach out to your BWA advisor if you would like to discuss your situation. Or to learn more about how Bordeaux Wealth Advisors can assist you, use the Get in Touch button above. We manage the complexities of wealth so you don’t have to.

Share: