For some individuals, charitable giving is a core component of their financial plan. In other words, the decision of whether to donate to a charitable organization is a given. For others, charitable giving happens sporadically when one feels the need and has the means to contribute. In either case, charitable giving will be a consideration in many peoples’ lives at some point. Importantly, there are ways to give efficiently that enable both the donor and the charitable organization to optimize the associated benefits.

Gifting to a charitable organization is a great way to potentially both lower your tax bill and provide a public benefit. There are many ways to make donations to a good cause, including giving cash, writing a check, donating noncash property, directly transferring securities, establishing a private foundation (which will then give grants to a final recipient organization), or utilizing a Donor Advised Fund (DAF). The common way of giving to a charity is to donate cash or appreciated assets yearly or when the organization needs it. Charities rely on these donations to execute their mission as well as to pay their staff. One major challenge of managing a nonprofit is dealing with the variability in donations.

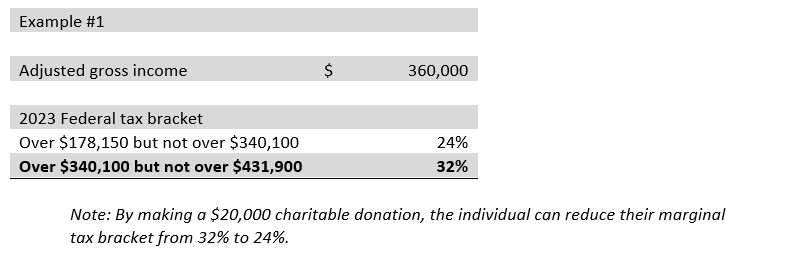

Donating to a charitable organization is a great way to lower your taxable income while ensuring your money goes to a cause that is important to you. If your income is tipping the scale into the next higher marginal tax bracket, you have an opportunity that might drop your marginal tax rate lower by making a charitable donation (see example below).

DAFs are an increasingly popular way for individuals to make donations, particularly of highly appreciated securities, to the nonprofit organizations of their choice. According to National Philanthropic Trust’s 2021 Donor-Advised Fund Report, from 2016 through 2020, the compound annual growth rate of DAF accounts was 36.4 percent, with the total number of DAFs rising to over one million.

DAFs work like your own foundation under the guidance of the donor (thus the “donor advised” in the name). An individual donates cash or securities to the DAF. Because the DAF is itself a 501(c)(3) organization, donations made to a DAF are tax-deductible in the year the donation is made, just like donations to other 501(c)(3) organizations. However, the funds do not necessarily need to be granted to charities in that same year. The funds can remain in the DAF to be invested until a charitable grant is requested. As grants to charitable organizations are made, the DAF portfolio balance is reduced by the grant amount and the charity receives a check.

A great feature of DAFs from the perspective of nonprofits, particularly in market downturns, is the “smoothing” effect they have on donations. Because DAFs can carry a balance from year to year, in times of market downturns or economic hardship, DAFs can continue to make grants as those funds have already been set aside for that purpose. This is often the time when these organizations need money the most. It may be difficult for someone to write a check when their own financial position is under stress but giving from a DAF has no impact on their current financial well-being. This can provide vital cashflow to charitable organizations in a downturn when potential donors would be less likely to contribute.

From the donor side, that same feature is also extremely valuable. When donors have a strong income year, their taxes will likely be higher as well, enabling them a potentially greater benefit from a large charitable donation. This helps reduce their tax burden and may even provide a more beneficial tax break if they are in a temporarily higher tax bracket. In those years, it makes sense to contribute more to their DAF than they will grant to charities in that year. The excess can be used for future years. During leaner earning years, they can reduce or eliminate their DAF contributions yet continue to support the charities they love because the funds are coming from their DAF, not from their bank account.

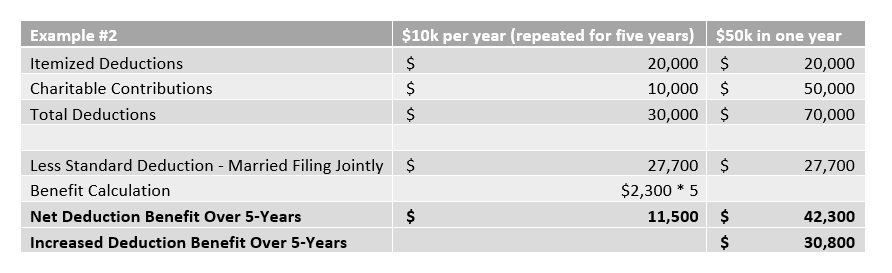

This charitable grouping – donating more in some years and less or none in other years – also has the advantage of allowing the donor to deduct more of their charitable donation, because when you save up your donations over several years and then make them all at once, a larger percentage of your donation in total might exceed the standard deduction.

The above comparison illustrates a $50k donation gifted two different ways. If $10k is given annually for five years, only $2,300 of the contribution is recognized as a deduction per year. In this case, over the five-year period, one will contribute $50,000 to charities, but only receive a net deduction benefit of $11,500: total deductions of $30,000 less the standard deduction of $27,700 multiplied by 5. If the same donor bundles their contributions into a single year, they will be able to recognize an additional $30,800 in deductions on their tax returns over that five-year period ($70,000 deduction less the standard deduction of $27,700 – yielding a deduction of $42,300 instead of $11,500).

Another benefit to the donor is that the funds contributed to a DAF can be invested, allowing the balance to grow over time. This might enable the donor to give more to a specific charity or to support more charitable causes. With a properly managed investment plan, the fund has the potential to grow over time to become a much bigger sum than what was originally established. Donor Advised Funds can be a very useful and versatile tool in any family’s philanthropic program. With proper planning and management, they can greatly benefit recipient organizations, and can help facilitate much needed cash flow for organizations performing public services in times of need.

To learn more about how we helped a BWA client with their charitable giving, click here for a client case study.

You can also visit www.bordeauxwealthadvisors.com or call 650-289-1105.

The outcomes discussed herein are for illustrative purposes only and are not representative of any one client’s experience. Actual tax savings may vary materially than those portrayed herein, and no portion of this information is to be construed as personalized financial advice. This article is not intended to provide tax or legal advice, and nothing contained in these materials should be taken as such. To determine which tax planning strategies may be appropriate for you, consult your tax advisor.

Share: