Fourth Quarter 2023

In our commentary at the end of the third quarter of 2023, we wrote that the most significant event in financial markets during the quarter was the rapid increase in interest rates. On October 18th, the 10-year US Treasury bond yield closed at 4.98%. That yield turned out to be the peak for the year. Rates increased from 3.27% on April 4th to the peak on October 18th. Markets were concerned that inflation would continue to be a problem for the economy, the Federal Reserve would keep interest rates high, and the ever-increasing Federal Debt would become more of an issue for investors. This increase in interest rates was also the catalyst for a 10% correction in the S&P 500 in September and October.

However, market sentiment can change quickly. As recently as Halloween, the yield on the 10-year Treasury was still at 4.88%. Then, at the end of October, several reports came out indicating that inflation was continuing to decline, the US economy was continuing to grow, and the market increasingly felt the Federal Reserve would be able to engineer a “soft landing” of the US economy. Interest rates started to decline quickly in November and December. On December 27th, the 10- year yield closed at 3.82%. This renewed optimism that inflation was coming back under control and that the Fed’s interest rate campaign was either done or near done spurred a strong rally in the US stock market. The S&P 500 increased 11% in the fourth quarter and was up 24.2% for the year.

INFLATION

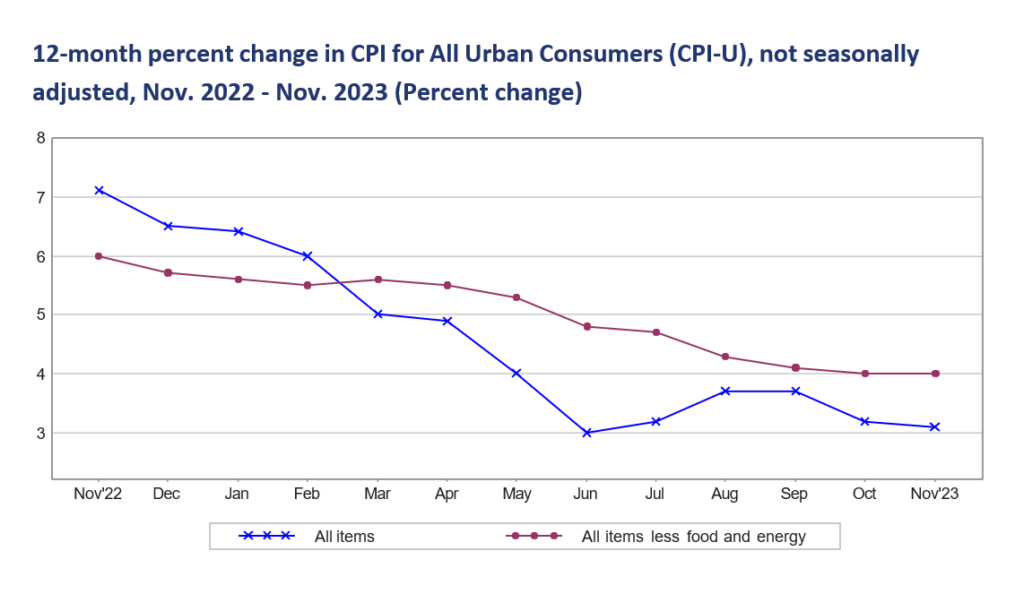

The primary reason for this decline in interest rates was increased optimism that inflation was returning to the Fed’s long- term goal of 2%. The Core Consumer Price Index (CPI) declined to an annual rate of 3.1% in November of 2023, down from 5.8% in January of 2023 and the most recent high of 9.1% in 2022[1].

Combined with an unexpectedly high 5.2% Gross Domestic Product (GDP) reading for the third quarter of 2023, markets rallied across the board in Q4.

The good news on inflation, combined with comments from Federal Reserve officials, caused markets to anticipate the Fed would begin cutting interest rates in 2024. The Fed Funds futures market is now predicting a 25-basis point decrease in the Fed Funds rate in March of 2024.

The good news on inflation, combined with comments from Federal Reserve officials, caused markets to anticipate the Fed would begin cutting interest rates in 2024. The Fed Funds futures market is now predicting a 25-basis point decrease in the Fed Funds rate in March of 2024.

2023 ECONOMIC AND MARKET RECAP

A year ago, market sentiment was uniformly negative. Financial markets were coming off one of the worst combined years for stocks and bonds since the 1970s. Inflation remained high, the Fed indicated that they would continue to raise rates and most economists were predicting a recession for the U.S. economy in 2023.

However, the US economy was remarkably resilient despite the headwinds of higher interest rates and high inflation. Although some sectors suffered from increased interest rates, most notably real estate, the labor market and consumer spending remained strong. After peaking in September, oil prices also sharply declined in the fourth quarter, further supporting consumer spending.

With the economy remaining strong and inflation coming back in line, US equity markets staged an impressive rally. The S&P 500 finished the year up 24.2% and the Nasdaq composite was up 43.4%. However, the strength in the stock market was not widespread, but strongly dependent on a few large technology companies, which have become known as the “Magnificent 7.” Led by Nvidia (up 238.9%) and Meta (+194.1%), these seven stocks (also including Microsoft, Apple, Amazon, Alphabet and Tesla) drove much of the total return of the indices. If you exclude those seven stocks, the S&P 500 was up about 8% for the year.

A surprisingly strong economy, the market optimism caused by the promise of Artificial Intelligence (AI), and the rebound from an extremely negative 2022 all generated significant optimism around these seven stocks.

WHY WERE ECONOMIC FORECASTS SO WRONG ?

Forecasting the economy is notoriously difficult, but how did so many economists get their 2023 predictions of a recession wrong? The main reasons are probably: 1) Continued impacts of the Covid era and 2) Federal government spending that resulted in a $2 trillion federal deficit.

The economic impacts of the Covid shutdowns were still being felt in 2023. For nearly two years, spending by Americans was curtailed by shutdowns and supply chain problems. While the government provided stimulus payments for many Americans, there were limited opportunities for them to spend the money, so there was an elevated level of savings during the Covid shutdowns. The estimates of excess savings in 2020 and 2021 were as high as $2.3 trillion. As the shutdowns ended, US consumers spent those excess savings, which kept consumer spending strong during 2022 and 2023. Additionally, a moratorium on student loan repayments for several years also generated excess spending that would have gone to debt service. However, most of the excess savings have now been spent down and student loan payments have restarted.

The second factor supporting consumer spending was deficit spending by the Federal government. The Federal Government ran an almost $2 trillion deficit in fiscal year 2023 as tax revenue dropped but stimulus spending continued. The total Federal Debt is now more than $34 trillion. While government spending helped prop up the economy in 2023, the level of the overall Federal debt may curtail spending going forward. These two factors probably offset the headwinds from higher interest rates, inflation, and geopolitical turmoil in 2023 that allowed the economy to outperform the more pessimistic forecasts from a year ago.

MARKET OUTLOOK

As compared to a year ago, there seems to be much more optimism about the economy going into 2024. It is understandable that having heard pessimistic outlooks over the last year that did not come true, combined with a strong US stock market, people would be more optimistic about the economy in 2024. However, there are headwinds for the economy going into 2024 and reasons to be defensive about equities:

- Uncertainty over Fed Policy – While the market expects the Fed to begin cutting rates in 2024, the timing and path are highly uncertain. An uptick in the inflation numbers could delay cuts or even raise the possibility of additional increases to make sure inflation is contained.

- High equity valuations – Increases in stock prices in 2023 outpaced the growth in earnings. The S&P 500 is now trading at about 22 times trailing earnings. Any decrease in earnings due to an economic slowdown could cause downward pressure on stocks.

- Level of government debt and debt service – As previously noted, the total Federal debt recently surpassed $34 trillion. Additionally, due to higher interest rates, the cost of total debt service has also increased to over $900 billion a year. As existing lower interest-rate Treasuries mature, they will need to be replaced at higher interest rates. Total debt service cost is expected to exceed $1 trillion per year soon.

- Inflation trending in the right direction but still higher than target – The most recent CPI report for November showed core CPI at 3.1% on an annual basis. This is still above the Fed’s 2% target.

- Economic Indicators – Despite continued growth in GDP in 2023, many indicators of future economic health are flashing warning signals.

- The yield curve remains inverted and has been since July of 2022. As of January 3, 2024, the 2-year Treasury was yielding 4.33% while the 10-year was yielding 3.95%. An inverted yield curve has often predicted an impending recession.

- Each month, the Conference Board releases its Leading Economic Indicators research. These are a set of economic statistics that have tended to predict where the economy is heading. The LEI’s have been negative for twenty consecutive months after November’s reading of -0.5%.

- Quantitative Tightening – While much of the focus on the Fed has been its interest rate policy, the Fed has also been shrinking its balance sheet which increased dramatically during the Covid crisis. The Fed increased its balance sheet by buying bonds in the open market, thus injecting more cash into the financial system. They are now letting those bonds mature and not replacing them. This serves to remove cash from the system. The result is that the M2 money supply declined by 3.3% in 2023 and is down nearly 5% since its peak in July 2022. That may not seem like much, but it is the biggest decrease in the M2 money supply since the Great Depression.

- Geopolitical Issues – Geopolitical issues continue to be a cause for worry. It has been nearly two years since the Russian invasion of Ukraine and the war continues. On October 7th, Hamas attacked Israel, which resulted in the Israeli invasion of Gaza. Fears of an expansion of the conflict across the greater Middle East and Persian Gulf remain an issue.

INVESTMENT IMPLICATIONS

Investor optimism is much higher going into 2024 than last year. Positive returns across most asset classes, especially US stocks, were a welcome surprise after the pain of 2022. However, valuations are now stretched and there are many issues confronting the economy. What does this mean for investors this year? Here are some of our thoughts:

- Interest rates may decline, especially if economic growth slows or the economy goes into recession. However, rates remain at attractive levels compared to the last 10+ years. Savers are being rewarded for the first time in years. Locking in higher interest rates now may be a good idea.

- Equity returns most likely will not be as high in 2024 as in 2023, especially in US growth stocks. Areas of the market that underperformed last year, such as small caps, value stocks and international equities may offer better opportunities.

- In the alternative space, Private Equity may have lower returns due to higher interest rates but will remain an attractive option due to the illiquidity premium and unique opportunities to invest in private companies.

- Real Estate, both public and private, was one of the worst performing sectors in 2023. Lower interest rates and more attractive valuations may improve the sector in 2024, but selectivity will be key.

Every year offers opportunities and risks and 2024 will be no different. There will be many economic issues to consider, and the Presidential election year will undoubtedly impact the US economic landscape. At Bordeaux Wealth Advisors, we will continue to watch the markets, adjust your portfolios when warranted and look for new opportunities. Thank you for your confidence in us and please let us know if you have any questions.

[1] Bureau of Labor Statistics – News Release, December 12, 2023

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance.

To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: