Choosing a financial advisor can be overwhelming; almost all advisory firms on the market promise that at their firm, clients come first, and they are dedicated to helping their clients optimize their financial situation. As a consumer, how can you be sure that’s true?

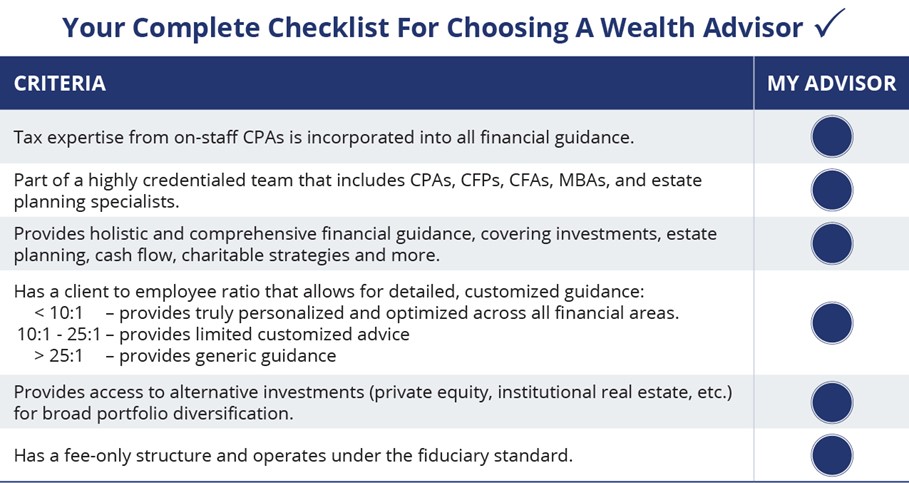

At Bordeaux Wealth Advisors, we believe there are several important factors in selecting the right wealth advisor – all summarized in the table below.

How do these criteria benefit you? Click here to learn more about why these factors are crucial to selecting the right wealth advisor.

We manage the complexities of wealth so you don’t have to.

- Does the advisor incorporate tax implication into their financial guidance? Do they have CPAs on staff or is their tax advice limited only to investments (tax loss harvesting, etc.)?

Understanding and planning for taxes is central to wealth management, so it’s critical that your advisor is qualified to provide comprehensive tax advice.

Key Benefit: Taxes are the biggest source of leakage of your wealth so having an advisor who understands taxes will help you minimize your tax bill, enabling you to keep more of your wealth. - Is the advisor part of a highly credentialed team, including CPAs, CFP’s, CFAs, MBAs and estate planning specialists?

Unfortunately the bar is not high to call oneself an advisor, leaving you to figure out who is actually qualified. Credentials are regulated and administered by independent bodies to guarantee that certain standards of knowledge are achieved. They provide validation that advisors have at least the minimum qualifications to perform the activities that they offer.

Key Benefit: Credentials are the basic building blocks of providing financial guidance and guarantee a standard level of knowledge. Without them, you don’t know what you are getting. - Does the advisor provide holistic guidance or are they primarily focused on investments (an investment advisor vs. a wealth advisor)?

The various parts of your financial life are intertwined and the only way to optimize your financial well-being is to have a comprehensive understanding of those interrelationships (taxes, investments, estate, equity compensation, charitable strategies, etc.). In addition to investments, does the advisor have the capacity and the qualifications to provide guidance on estate planning, taxes, cash flow, charitable strategies, etc.?

Key Benefit: Significant amounts of money can be left on the table by myopically managing one’s wealth. A holistic wealth advisor can provide complete financial guidance in a coordinated and seamless manner, optimizing your complete financial picture - What’s the firm’s client to employee ratio?

The lower the client-to-employee ratio, the more your advisor has the capacity to customize their advice model and take the time to optimize your financial outcome. Many firms have been built to scale their business, with scale coming through standardized, “cookie-cutter” offerings. The lower the ratio, the better it is for you, and here is a good rule-of-thumb:- Ratios of <10:1 are best-in-class and provide the capacity to customize across multiple financial topics areas. Enables a firm to provide comprehensive guidance for large, complex clients.

- Ratios of 10:1 to 25:1 These ratios provide a fair amount of focus on each client, but are not likely comprehensive in scope. The model is more appropriate for small to mid-size clients (< $5 million in assets) with little financial complexity.

- Ratios >25:1. Firms are built to scale. The model may be appropriate for investment-only advice, perhaps also including an annual financial plan.

- Ratios >50:1. Expect a much lower fee and reduced services. May be appropriate for small clients (< $1 million in assets) who are looking for investment-only guidance.

Key Benefit: A wealth advisor with a smaller client to employee ratio can provide you more time, attention and customized service. They have the capacity to review and guide you on your entire financial picture.

- Does the advisor provide broad portfolio diversification?

Broader portfolio diversification reduces risk and provides more opportunities to generate returns. For clients with more than $5 million in investable assets, we believe investing across a variety of asset categories – private equity, institutional real estate, alternative investments, managed volatility, domestic equities, international equities and fixed income provides the opportunity to generate attractive returns with lower volatility.

Key Benefit: Access to a broad selection of institutional investments is a key way to enhance the risk-return characteristics of your portfolio.

- What is the advisor’s fee structure? Do they follow the fiduciary standard?

Fee-only advisors earn revenue exclusively through the fee their clients pay them directly, not through commissions, marketing fees, or management fees on proprietary products. Advisors operating under the fiduciary standard are legally bound to do what is in their client’s best interest, whereas advisors working under the lesser suitability standard are not.

Key Benefit: You can be confident that the advice that you are receiving is truly in your best interest (not the advisor’s).

As you research wealth advisors, there are many considerations. We encourage you to use this checklist to evaluate any potential provider.

Read the second article in this series

Read the first article in this series