The Bond Market Vigilantes Part II — Debt and Deficits

Bordeaux Wealth Advisors | July 25, 2024

Almost one year ago in our quarterly letter, we discussed the rapid rise of interest rates that occurred in 2022 and what might transpire in the economy, fiscal policy and the equity market. Well, equity market volatility subsided, the economy did slow (but not into a recession) and higher bond yields have provided meaningful returns to investors since then. Two out of three right is not that bad.

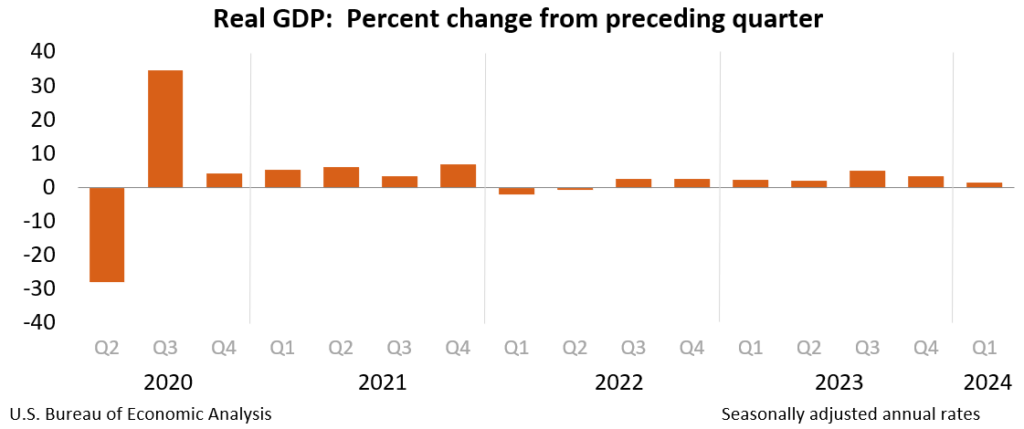

Now, as the second quarter of 2024 has ended, cautious optimism has once again spread across capital markets. During the year’s first half, markets focused on when the U.S. Federal Reserve would begin cutting interest rates. Since their last interest rate increase in July of 2023, the Fed has been on hold as they watched for progress on inflation and monitored the impact of their campaign of interest rate increases, between March of 2022 and July of 2023, on the overall economy. Despite the expectations of many economists, the U.S. economy has thus far avoided a recession, with the latest GDP numbers showing a 1.4% increase for Q1 2024. This was down from 3.4% in Q4 of 2023, but optimism remains that the Fed will engineer a soft landing of the economy.

The latest inflation numbers showed CPI decreased by 0.1% month over month in June and was up 3.0% year over year. This level of inflation is slightly above the Fed’s target of 2%, though the trajectory remains downward despite some upward blips in the first quarter of this year.

Capital markets reacted positively to this continued economic growth and progress on inflation. The S&P 500 was up 4.3% during the second quarter of the year. The stock market was again led by technology stocks as the NASDAQ was up 8.5% during Q2. Familiar names such as Nvidia, Alphabet, Microsoft, and Meta continued to drive markets higher. Progress on inflation kept the bond market steady with the US 10-year Treasury bond finishing the quarter with a yield of 4.36%, up 16 bps for the quarter. After the June inflation numbers were released in early July, the bond market rallied, and the 10-year yield fell to 4.15% in mid-July.

Yield on the 10-Year US Treasury Bond[1]

The Federal Reserve has a dual mandate: Price stability (low inflation) and low unemployment. As the inflation rate has moderated, the most recent unemployment numbers have ticked up, signaling a slowing economy. In June of 2024, the unemployment rate increased to 4.1%. The continued progress on inflation and the increasing unemployment numbers have increased the odds of a rate cut from the Fed this fall. The next Fed meeting is July 31, and while the Fed Funds futures market is only predicting a small chance of a rate cut at this meeting it is now predicting a 93% chance of a 25-basis point cut at the September meeting and roughly a 50% probability of cuts at the final two meetings of the year in November and December.

U.S. Elections

Another topic that will dominate investors’ attention over the next three months is the looming U.S. elections in November. The Presidential election will garner the most attention, but control of the Senate and House of Representatives will also be decided — and we believe the latter could be more important to the economy. As polls move and investors try to determine the impact on the economy of various outcomes, markets will continue to fluctuate on speculation about the policies that will come out of a future Administration and Congress. The media will attribute market moves in the short run to the latest political developments, but the election could have a real impact on markets, even if it is based on speculation about future economic developments.

Regardless of the outcome of the elections, the next President and Congress may well have the ability to enact new economic policies restricted by one significant impediment: A very large (and growing) level of U.S. Federal Debt. Currently, the total Federal Debt is approaching $35 Trillion and is increasing by roughly $1 Trillion every one hundred days. That level of debt equates to about $103,500 per U.S. citizen and $266,950 per taxpayer. With the increase in interest rates over the last two years, the cost to service the debt has now surpassed the total amount spent on national Defense and trails only spending on Social Security and Medicare as a component of the annual Federal Budget.

The big question is whether capital markets will continue to fund the U.S. debt at the current level of interest rates — or will we see a return of the bond market vigilantes? As a reminder, this was a phrase coined during the first term of the Clinton Administration. As the federal government debated tax policy and federal spending, any time a proposal was put forth that would increase the deficit, interest rates would quickly increase, threatening to slow the economy. The fixed-income traders who drove these interest rate increases became known as “bond market vigilantes” that forced budget discipline upon the federal government.

We now consider the possibility of a new generation of bond market vigilantes starting to influence economic policy. The internal mechanics of the bond market are already showing some stress as the U.S. Treasury holds auctions to refinance maturing debt and raise new funds to finance government deficits. The reaction of bond market investors to any new economic policies proposed by the next Administration in early 2025 will be crucial. While it is not a perfect comparison, the recent political and economic experiences in the United Kingdom (UK) may hold important lessons.

Bond Market Vigilantes in the UK

On October 20, 2022, Liz Truss resigned as Prime Minister (PM) of England after only 45 days in office, becoming the shortest-serving PM in British history. After becoming Prime Minister in early September of 2022, she proposed a package of tax cuts and increased government spending to stimulate the British economy following the Covid pandemic. World financial markets did not look favorably on her proposals. Markets feared a significant increase in the UK government deficit and runaway inflation. Interest rates spiked as bond prices plunged, the British Pound fell to an all-time low against the U.S. dollar and several British pension funds were faced with a solvency crisis. The Bank of England had to intervene several times to prop up the Pound and restore order in financial markets. The overwhelmingly negative reactions from markets led to her resignation six weeks into her term.

Furthermore, her successor, Rishi Sunak, called a snap election in England for July 4, 2024 after just two years in the position. The result was the Labour party enjoyed a landslide victory naming Keir Starmer as the new Prime Minister replacing Mr. Sunak, having won 412 of 650 seats and regaining control of the British government after 14 years of Conservative rule. While the political system in the United States is quite different than the British system, this experience should not be lost on U.S. politicians. The British version of bond market vigilantes removed a British Prime Minister and triggered a change in control of the British government.

Implications for the U.S.

The political system in the United States is quite different than the British parliamentary system. And the U.S. economy has some significant differences and current advantages over the British economy. The U.S. is still the largest economy in the world, and we enjoy the benefits of the dollar being the global reserve currency. Since this debt is denominated in dollars, it can be paid in dollars and the Federal government controls the Treasury printing of currency to pay it.

Still, the sheer size of the debt, and its continued growth, creates risks for the economy. In 2000, the Federal debt was 57% of the total GDP of the U.S. Currently, it is about 122%. As previously noted, simply paying the interest on the debt now costs over $1 trillion per year and is the third largest segment of the overall budget, behind only Social Security and Medicare expenditures.

For the last 25 years, neither political party has evidenced much fiscal discipline. Current Congressional Budget Office (CBO) projections show deficits running at $1 trillion per year for the foreseeable future. As the debt continues to climb, borrowing by the Federal government can crowd other borrowers around the globe. If investors demand higher returns to buy U.S. Treasuries, it could cause an increase in interest rates on these bonds as well as all bonds in the market. Additionally, expanding the money supply (printing dollars) to finance the debt can also cause increased inflation within the economy.

Many market observers and economists have worried for years about the level of government debt. Thus far, there have been few negative consequences, but this could change. The U.S. enjoyed exceptionally low interest rates for most of the last 25 years, which in part led to rapid increases in the value of many assets. However, the level of government debt may be one of the key factors leading to persistently higher interest rates going forward. The recent increase in interest rates has had a negative impact on real estate values. At the beginning of 2024, many investors expected the Federal Reserve to begin cutting rates soon. Persistent inflation has continued to push the first cuts later and later. While the Fed may soon start lowering rates, structural changes in the economy and the impact of the Federal debt could portend that rates are not going to return to the ultra-low levels experienced over much of the last twenty years. Additionally, higher tax rates may well be the result of Congressional efforts to reduce the deficit, as it seems improbable that the federal government can sufficiently decrease the deficit through spending cuts alone.

What We Are Doing

The last 18 months have shown the difficulty of accurately predicting the economy and financial markets. At the end of 2022, a recession in 2023 was widely expected. At the beginning of 2024, many economists predicted six interest rate cuts by the Fed this year. Neither of these predictions has proven accurate. We strive to maintain intellectual humility and not make substantial changes to our client portfolios based on imperfect macroeconomic predictions.

We endeavor to maintain discipline in our long-term investment strategies. Currently, these include the following:

- The U.S. stock market has fully recovered from the 2022 downturn and has reached new all-time highs, led by the Mega Cap technology stocks in market-cap weighted indices. We are actively rebalancing asset allocations back to our long-term targets to make sure our clients are not overweight to these and other risk assets.

- Although it is widely expected that the Federal Reserve will soon begin cutting interest rates, there is a strong likelihood that interest rates will remain at higher levels going forward as compared to the last 20 years. Fixed Income is now a much more compelling asset class than it has been in the recent past, and this suggests clients increase or add to their allocations, particularly municipal bonds which stand to benefit should income tax rates increase in the future.

- Real Estate has been one of the most negatively impacted asset class over the last 18 months from higher interest rates. While no one can accurately time when a bottom is reached, we are monitoring the real estate asset sector and trying to find specific areas that look most favorable to continue investing in, such as multi-family housing, warehouses, logistics, and data centers.

As Yogi Berra once said, “It is difficult to make predictions, especially about the future.” The upcoming elections, geopolitical events and changes in the economy will continue to influence capital markets over the coming months. As your advisor, Bordeaux Wealth will continue to monitor events and recommend changes in your portfolios as necessary. Thank you for your continued faith in us and, as always, contact your advisory team if you have any questions or concerns.

[1] Financial Times, July 17, 2024

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance. To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: