Third Quarter 2024

Interest Rates, Elections, and A.I.

Bordeaux Wealth Advisors | October 25, 2024

We often find that there are common issues that people ask us about. Recently, the most frequent questions have been about the direction of interest rates, how the outcome of the 2024 elections will impact financial markets, and if and how they should invest in Artificial Intelligence (“AI”). We will share some thoughts on those three areas in this quarterly letter.

INTEREST RATES

After much speculation over the last year and a half, the Federal Reserve finally lowered its benchmark interest rate at its September 18th meeting. This was the Fed’s first lowering of interest rates since 2020. The market had been expecting the rate cut, but its size caught many by surprise. The Federal Reserve reduced rates by 50 basis points, the largest since March of 2020, when the Fed was reacting to the beginning of Covid.

The Fed commented following the meeting that they were moving from being predominantly worried about inflation to balancing the need to keep both inflation and unemployment low. During public comments after the announcement, Federal Reserve Chairman Jerome Powell said, “We’re committed to maintaining our economy’s strength by supporting maximum employment and returning inflation to our 2 percent goal”.

The Fed started its campaign of increasing interest rates in March of 2022 to combat inflation that had recently peaked at over 9%. Their campaign resulted in increasing the Fed Funds rate from a level of 0.25% to a high of 5.50%. This rapid and significant increase in interest rates pushed short-term rates higher across the economy and resulted in an inverted yield curve. An inverted yield curve is when short-term rates are higher than long-term rates and is often seen as a signal that a recession is imminent. The inverted yield curve began in July of 2022 and remained inverted until last month following this recent interest rate cut.

The market has been focused on interest rates hoping they would come down, which would support economic growth and help avoid a recession. However, after the Fed’s actions, longer-term rates increased. On September 19th, the day after the Fed’s announcement, the 10-year U.S. Treasury yielded 3.73%. After better-than-expected employment numbers released on October 1st, the yield on the 10-year Treasury increased and closed at 4.092% on October 11th. The yield curve has returned to a more normal shape, although parts of the short end are still higher than the long end.

The increase in the 10-year rate reinforces something we have written about previously. Interest rates may remain higher for longer. The era of ultra-low interest rates is likely over, probably for a long time. A variety of factors, such as government deficits and the end of globalization, could keep interest rates at higher levels than in the last 10-15 years. However, a 4.1% 10-year Treasury yield is not high by historical standards but should be taken as more of a return to normalcy.

ELECTIONS

The 2024 general election is three weeks away as we write this letter. While there are many critical issues for voters, we usually are asked our opinion on how the outcome will impact the economy and markets. We think several issues are important to the economy. Only some of these have been addressed by the campaigns though we suspect that whoever is in office will need to deal with all these difficult matters.

INFLATION

Inflation in 2021 and 2022 hit multi-decade highs. Although the rate of inflation has slowed, prices are still significantly higher than they were five years ago. Much of the inflationary pressures can be attributed to the COVID-era shutdowns and the resulting fiscal stimulus from the Federal government. Evidence of “sticky” inflation can be seen in the recent strikes by workers at Boeing and at East Coast ports, as those employees were asking for dramatic pay increases to compensate for the inflated costs of goods and services in their daily lives.

We also think inflation may continue to be a problem due to the size of the Federal debt and a trend toward de-globalization and both candidate’s proposals have inflationary aspects to them. Inflation in the U.S. had been extremely low from the mid-1990s up until about 2020. The U.S. benefited from cheap imports, primarily from Asia, which helped to keep inflation low. However, deteriorating relations with China and a move to return more manufacturing to domestic soil may reduce cheap imports and potentially push inflation in the future.

DEFICITS

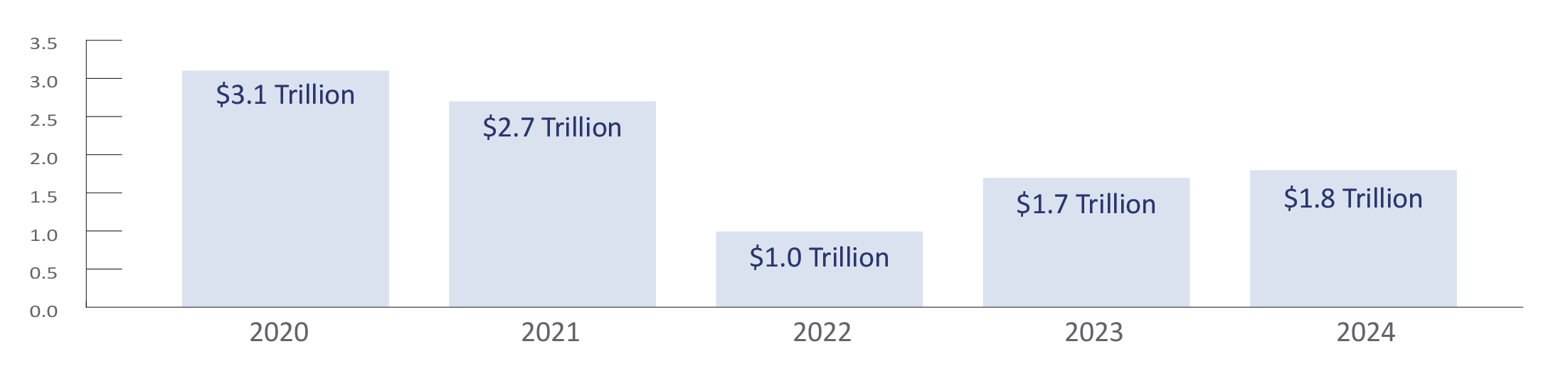

The total Federal debt now stands at approximately $36 Trillion. Over the last five years, the annual deficit of the Federal government has been as follows:

The deficits in 2020 and 2021 were understandable reactions to the Covid crisis and economic shutdowns. Although these deficits may have stimulated the economy and helped avoid a severe recession, the sheer supply of money contributed to inflation. We find it interesting that neither Presidential campaign has made a reduction in the deficit an issue. Perhaps it is because both the political parties have contributed to these deficits, but the rising deficits and cost of our debt are beginning to reach an unsustainable point.

INCOME TAXES

As usual, both Presidential campaigns are making taxes a major issue. Promises to either cut tax rates or raise taxes for select groups of citizens are being made by both sides. However, it is worth emphasizing that the President does not write the tax law. That is the job of Congress. Whether Harris or Trump wins the Presidency, unless they also have significant majorities in both houses of Congress, dramatic changes to tax policy are not likely. And it seems probable that Congress will again be evenly split between the two parties creating the checks and balances that was originally intended.

The one thing we do know about taxes is that the current tax law passed in 2017 will sunset at the end of 2025 unless Congress acts to extend it or change it. To comply with budgeting rules, Congress established an end date for the Tax Cuts and Jobs Act (TJCA) of 2017. If Congress does not act next year, several provisions will revert to pre-2017 levels. These will include:

- Higher individual tax brackets and rates.

- The $10K limit on State and Local Tax (SALT) deductions will be lifted.

- The increased standard deduction will decrease, potentially leading to more taxpayers itemizing deductions on their returns.

- The Estate Tax Exemption will decrease, roughly being cut in half from where it is today ($13.6 million per person in 2024).

What direction tax law takes over the next two years will depend on which party controls Congress as well as the White House. Given that neither party will likely control both Houses by significant margins, it is probably prudent to assume that the changes from the 2017 TCJA will expire at the end of 2025.

INVESTING IN AI

Despite the uncertainty around interest rates, the election, and continuing geopolitical turmoil, the first nine months of 2024 have been positive for equity markets. Through September 30, 2024, the S&P 500 is up 22.08% and the NASDAQ composite is up 21.84%. Once again, market returns have been driven by a select number of Mega Cap technology stocks, namely: Nvidia, Meta, Microsoft, Alphabet, Microsoft, and Amazon. While all these businesses are great franchises with strong cash flow and profits, much of this year’s performance can be attributed to the market’s enthusiasm for Artificial Intelligence.

The AI landscape has experienced significant growth this year, with advancements in machine learning, natural language processing, and automation paving the way for new applications across diverse sectors, including healthcare, finance, and manufacturing. The global AI market is projected to grow revenue opportunities from $190 billion in 2024 to over $800 billion by 2030, driven by increased investment, technological advancement, and the widespread adoption of AI solutions.

Nvidia is a direct beneficiary of this trend, as they manufacture the semiconductor chips most in demand for powering the computers running A.I. applications. Proponents of the revolutionary nature of AI think that it will change almost every aspect of our economy. But one thing that has become clear is that developing and building out AI capabilities will be tremendously expensive and take time to perfect. One of the biggest advantages of the hyper-scalers like Meta, Microsoft and Alphabet is that they have the available resources to invest in this development process due to the success of their other businesses.

Beyond this group, it is more difficult to spot the eventual winners in the AI space. Will it be companies that develop AI technologies or companies that can use them most effectively to improve their profitability? Will it be those companies that build the hard infrastructure necessary to support the use of AI or will it instead be the software applications and innovative technologies built where AI creates efficiencies and new markets and services yet to be created? We suspect it will be a combination of all of the above. But like the dot.com era of the late 90’s, it will be difficult to spot the winners and losers until after the fact.

We seek to get our clients invested in the future growth of A.I. through both public and private investments. Broad-based market index funds give investors wide exposure to the various publicly traded companies that are investing in AI. Private market investments, such as Private Equity or Venture Capital will search for new companies in the AI space, which appears the more likely path of investment success. Finally, infrastructure and real estate managers continue to build and own the energy grid and data centers to support the development of this technology and their need for access to reliable sources of energy and housing of the hardware tools that lie in the background from these businesses.

SUMMARY

As we enter the fourth quarter of 2024, we have seen positive returns across client portfolios. Both U.S. and International equities have performed well. Inflation has come back to near the Federal Reserve’s 2% target, which should help the Fed continue to cut interest rates, but perhaps not as quickly as some may expect. The election will bring some clarity to the government for the next two years, but we remain skeptical that there will be significant new tax legislation. We also continue to worry about the level of the Federal debt and budget deficits and whether those factors could reignite future inflation and interest rates.

We continue to monitor markets and the economy as we manage your portfolios. Thank you for the trust you have shown in us. Please contact your Advisor with any questions or concerns you may have.

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance.

To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: