A trust is a fiduciary arrangement that allows a third party or trustee to execute fiduciary functions on behalf of the beneficiaries. Under the traditional trust model, a trust names one trustee (or co-trustees) to perform investment management, trust distributions and all administrative responsibilities of the trust. In another word, nearly all decisions surrounding the trust are made by one single trustee.

However, a single trustee may not always have the knowledge, expertise, time or resources to fully administer a trust and handle the workload, especially when the investment portfolio of the trust requires a more specialized oversight. In some instances, under the traditional trust model, the single trustee spends more time working on compliance issues or tax matters than servicing the needs of the beneficiaries.

In a directed trust, by contrast, the terms of the trust may separate certain responsibilities traditionally held by a single trustee, depending on the applicable state law. Directed trusts have gained in popularity over the past decade, largely driven by wealthy clients’ desire to structure complex objectives and manage non-traditional assets, which may require specialized knowledge.

WHAT IS A DIRECTED TRUST ?

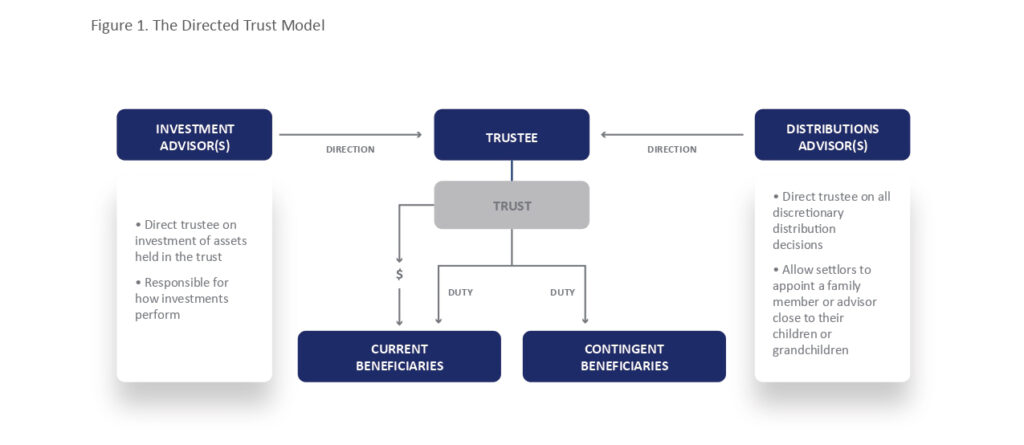

A directed trust is a trust for which the terms of the trust grant a power of direction.1 Under a directed-trust model, it is common that investment advisor(s) and distributions advisor(s) are named to carry out essential functions when directing the trustee and removing certain duties from the trustee. The trustee generally performs administration duties and is held responsible for the proper execution of the trust (Figure 1).

A directed trust is a trust for which the terms of the trust grant a power of direction.1 Under a directed-trust model, it is common that investment advisor(s) and distributions advisor(s) are named to carry out essential functions when directing the trustee and removing certain duties from the trustee. The trustee generally performs administration duties and is held responsible for the proper execution of the trust (Figure 1).

- The investment advisor(s) has the power and authority over the trust’s assets and is responsible for managing the investments and overseeing their performance. Investment advisor(s) typically performs investment-management duties according to an Investment Policy Statement.

- The distributions advisor(s) has the power and authority to direct the trustee regarding discretionary distribution decisions.

- The trustee’s primary duties fall into non-discretionary tasks and discretionary tasks. A trustee’s powers may include taking ownership of assets, opening and maintaining bank accounts, preparing trust statements and tax returns, and taking direction from investment advisor(s) and distributions advisor(s). The trustee must also attend to other matters the trust or the governing instrument directs and carry out the duties as stated in the trust agreement.

By delegating certain responsibilities to the Investment Advisor and the Distribution Advisor, the trust can be more effectively administered and the trust assets better managed. As illustrated in Figure 1, the structure of directed trusts benefits current beneficiaries (i.e., the beneficiaries who are currently entitled to the income from the trust) and contingent beneficiaries (i.e., the future beneficiaries that have an interest in the trust after the current beneficiaries’ interest is over).

TRUST DIRECTOR : PROTECTING BENEFICIARIES’ LONG – TERM VISION AND ENHANCING FLEXIBILITY

In a 2021 study on trusts2, some trust clients indicated that although they valued attributes such as transparency and ethical business practices in the trust industry, they were often frustrated because their trust assets were not managed in the investment approach that lined up with their investment philosophy. Some also complained that the standard of living or lifestyle of the beneficiaries was not taken into account when the distributions were made. In other words, the investments and discretionary distributions of these trust clients did not work for them in the ways they needed, since the trustee did not know the beneficiaries personally and may not have the investment expertise needed to properly manage the assets.

The Uniform Directed Trust Act (UDTA) introduces the definition of a trust director (“trust advisor” or “trust protector”), which refers to a person other than the trustee that is granted a power of direction by the terms of a trust3. The trust director can be a beneficiary or settlor of the trust, certain family member or family advisor.

The trust director can help make more appropriate investments and discretionary distribution decisions. The trust director can also help set distribution guidelines on how the settlor would like the trust assets to be used for future generations, who may live a completely different lifestyle at a younger age. Through this power to appoint trust advisors, trust clients can build more flexibility into the directed trust. Meanwhile, with a trust director in place, the trustee can better execute the trust. In the trust industry, the power to appoint trust advisors is becoming increasingly popular for various reasons in facilitating future flexibility.

THE EVOLUTION OF DIRECTED TRUSTS

The trust industry has been undergoing a quiet revolution and one of the most significant changes in the past 25 years relates to who performs the critical duties of the trust and how these duties are assigned. The Restatement (Second) of Trusts, which first addressed directed trusts in § 185, was published in 19594:

Nearly a half-century later, the Restatement (Third) of Trusts opined on directed trusts. Its most noticeable deviation from § 185 of the Restatement (Second) pertains to the trustee’s review of the powerholder’s direction that was exercised in a fiduciary capacity. Under § 75 of the Restatement (Third), the trustee must refuse to comply with the direction if he or she knows, or has a reason to suspect, that the powerholder is violating a fiduciary duty.5

The Uniform Trust Code (UTC), which was initially drafted by the Uniform Law Commission (ULC) in 2000, provides powers to direct in § 8086. Although the UTC was drafted in close coordination with the writing of the Restatement (Third), “If under the terms of the trust a person has power to control the action of the trustee in certain respects, the trustee is under a duty to act in accordance with the exercise of such power, unless the attempted exercise of the power violates the terms of the trust or is a violation of a fiduciary duty to which such person is subject in the exercise of the power.”it differs from the Restatement (Third) in several major sections, such as in the Exceptions to Spendthrift Provision (UTC § 503), the Resignation of Trustee (UTC § 705) and the Removal of Trustee (UTC § 706). Traditionally, it had been difficult to remove a trustee named by the settlor than a trustee named by the court7.

“If under the terms of the trust a person has power to control the action of the trustee in certain respects, the trustee is under a duty to act in accordance with the exercise of such power, unless the attempted exercise of the power violates the terms of the trust or is a violation of a fiduciary duty to which such person is subject in the exercise of the power.”

In July 2017, in response to addressing the many complications and the ineffectiveness of the UTC as a framework for directed trusts, the ULC drafted and enacted the UDTA8. The UDTA introduces the definitions of “breach of trust” and “power of direction” and outlines the duties, powers, limitations and liabilities of powerholders and directed trustees9.

The UDTA provides “clear, functional rules that allow a settlor to freely structure a directed trust for any situation while preserving key fiduciary safeguards for beneficiaries”, according to the ULC10.

States were then beginning to view the UDTA as a viable directed-trust model. Meanwhile, estate-planning and fiduciary communities were beginning to view multi-participant trusts as comprehensive, beneficiary-centered and holistic planning tools. Alaska, Delaware, Nevada, New Hampshire, South Dakota and Tennessee have been the leaders in enacting new statutes that override various aspects of common trust law in the United States. Specifics vary by state in their treatments and uses of directed trusts, and the laws of each state have many nuances. As of this writing, many state laws and directed-trust statutes have been well established in that the division of responsibilities and liabilities for breach of duty of care is clear11, although a few states have not enacted some form of directed-trust statute, noticeably California and New York12.

As a result, clients with special wealth-management needs or complex family wealth structures are more comfortable using directed trusts as their estate-planning solutions in those states with better trust jurisdictions, regardless of where they reside.

TOP BENEFITS OF A DIRECTED TRUST

Split Trustee’s Duties And Provide More Flexibility And Control

A directed trust allows clients to retain control over key decisions while leaving all other decisions in the hands of a professional and regulated trustee. Directed-trust statutes accommodate multiple fiduciaries and non-fiduciary appointments more easily. Under a directed trust, clients do not need to worry about exotic duties, and as their family wealth grows, having a mechanism that separates duties in place can also enhance control.

Keep Standards High Over Time

Directed trusts are regulated and they have a strong operational structure in place. The trustee takes care of administrative duties such as record keeping and accounting. The distributions advisor(s) takes care of family needs and values when making discretionary distribution decisions of the trust assets. The investment advisor(s) focuses solely on investments, and with multiple investment advisors, each of them can take responsibility for a different asset class or investment platform.

Under the directed-trust model, both the trustee and advisors can do what they do best, which aligns with the best interests of the current and contingent beneficiaries.

Clients will feel secure since their trusted advisors and focused experts are in charge of their family wealth. With a trust director sitting in the directed trust, clients’ family wealth will also transition as they have intended. As one’s family wealth structures become more sophisticated, having a directed trust that separates duties will also enhance specialization and continually create a high standard.

Protect The Long – Term Vision

Directed trusts provide some benefits beyond the self-trustee model and offer a certain level of protection. The creation of a directed trust adds an element of continuity of service, which allows for long-term success in estate planning. If trust clients can structure their directed trust with a trust director who is more familiar with their long-term vision, they will be more confident about accomplishing their desired outcomes.

CONSIDER A DIRECTED TRUST ?

As clients’ wealth-management needs and family wealth structure become more complex, and with clients’ increased desire to control and optimize their continued wealth, directed trusts are powerful estate-planning solutions for both clients and their advisors. A directed trust also allows wealthy clients to preserve, protect and grow non-traditional assets, such as closely held businesses, family limited partnerships, limited liability companies and private equity interests. Importantly, as many state laws and directed-trust statutes have evolved and matured to a point where the division of responsibilities and liabilities is clear and provisions are flexible, clients have gained greater confidence in creating a directed trust.

The administration function often surfaces as a key element in the decision- making process ultimately, so it is of great importance to choose a proper corporate trustee that understands the plans, the language in the governing document and the laws of the applicable state. Moreover, the investment advisor(s) and distribution advisor(s) should not have a conflict of interest with the beneficiaries. Although there are no definitive guidelines, when choosing a prospective trustee, trust clients should make sure they can work well with the trustee.

The state of administration (“situs”) and governing law are also important decisions that require careful consideration. State laws determine how a directed trust is taxed, how much control investment advisor(s) and distributions advisor(s) can have over investments and discretionary distribution decisions, and the applicable tools and techniques for making changes to a directed trust in the future. State laws are also associated with other practical concerns, such as the legal community, the court system and industry presence. Therefore, when setting up a directed trust, it is crucial to choose the correct jurisdiction for the governing law to enhance the flexibility of the directed trust. Choosing a situs with clarity regarding delineating the separate duties that advisors and trustees perform is also critical for establishing the standard of care owed to the beneficiaries.

CHANGING A TRADITIONAL TRUST INTO A DIRECTED TRUST

To change a trust document to accommodate a directed trust, trust clients can consider several ways. Powers may exist within the trust document to change the trust, vested in the trustee or trust protector. If such powers do not exist in the trust document, all parties to the trust can enter into a nonjudicial settlement agreement (i.e., a contract between the beneficiaries of a trust that can modify the terms of the trust), or a judicial settlement agreement if not everyone agrees.

Clients should consider incorporating flexible provisions in their trusts in order to be able to address future conditions.

Depending on the applicable state law, the trustee can often decant the trust into a whole new trust with new provisions. When effecting a change to a trust, all parties must review the requirements carefully and ensure they follow the correct procedure.

Clients should consider incorporating flexible provisions in their trusts in order to be able to address future conditions.

To conclude, directed trusts are authorized by separate and distinct state statutes that override the common rule against non-delegation of trustee duties. With the increasing number of variables and elements that can be built into the directed-trust structure, along with the more flexible and favorable trust laws in many states, directed trusts are becoming more powerful for future estate planning than ever. A directed trust allows flexibility and control in trust administration, trust execution, as well as trust succession provisions. Further, choosing the correct jurisdiction for the governing law allows for an even greater level of flexibility.

Clients who have trusts, or are contemplating trusts, should talk to their advisors about how a directed trust might benefit their situation.

-

- National Conference of Commissioners on Uniform State Laws. (2021). Uniform Directed Trust Act. Annual Conference Meeting in Its 126 Year, San Diego, California, July 14-July 20, 2017. https://www.uniformlaws.org/

- The Wealth Advisor. (2022). 2021 America’s Most Advisor-Friendly Trust Companies. https://theprivatetrustcompany.com/

- National Conference of Commissioners on Uniform State Laws. (2021). Uniform Directed Trust Act. Annual Conference Meeting in Its 126 Year, San Diego, California, July 14-July 20, 2017. https://www.uniformlaws.org/

- Lucius, W. D., & Whitenack, S. B. (2019). Directed trusts: A primer on the bifurcation of trust powers, duties, and liabilities in special needs planning. The National Academy of Elder Law Attorneys, Inc. (NAELA) Journal, 15, 71-88. https://www.naela.org/NewsJournalOnline/

- Schwartzel, B. C. (2021). Was it wise to try to implement trust law reforms through the Uniform Prudent Management of Institutional Funds Act?. Estate Planning & Community Property Law Journal, 14, 179-250. https://epj.us/

- Spica, J. P. (2019). Settlor-authorized fiduciary indifference to trust purposes and the interests of beneficiaries under the Uniform Trust Code. Michigan Probate & Estate Planning, 39, 2-10. https://connect.michbar.org/probate/home

- National Conference of Commissioners on Uniform State Laws. (2003). Uniform Trust Code. Annual Conference Meeting in Its 109th Year, St. Augustine, Florida, July 28-August 4, 2000. https://www.uniformlaws.org/

- National Conference of Commissioners on Uniform State Laws. (2021). Uniform Directed Trust Act. Annual Conference Meeting in Its 126 Year, San Diego, California, July 14-July 20, 2017. https://www.uniformlaws.org/

- Morley, J. D., & Sitkoff, R. H. (2019). Making directed trust work: The Uniform Directed Trust Act. ACTEC Law Journal, 44(3). https://www.actec.org/

- National Conference of Commissioners on Uniform State Laws. (2021). Uniform Directed Trust Act. Annual

- O’Hagan, P. (2021). ‘You Say Tomatoes’ – avoiding trustee liability for breach of duties of care in English and US style trust deeds. Trusts & Trustees, 27(3), 175–186. https://doi.org/10.1093/tandt/ttab009

- Holbrook, D., & Hess, A. M. (2021). The rise of directed trusts and why it matters. Tennessee Bar Journal, 57, 50-51. https://www.tba.org/?pg=TennesseeBarJournal

REFERENCES

- Holbrook, D., & Hess, A. M. (2021). The rise of directed trusts and why it matters. Tennessee Bar Journal, 57, 50-51. https://www.tba.org/?pg=TennesseeBar-Journal

- Lucius, W. D., & Whitenack, S. B. (2019). Directed trusts: A primer on the bifurcation of trust powers, duties, and liabilities in special needs planning. The National Academy of Elder Law Attorneys, Inc. (NAELA) Journal, 15, 71-88. https://www.naela.org/NewsJournalOnline/

- Morley, J. D., & Sitkoff, R. H. (2019). Making directed trust work: The Uniform Directed Trust Act. ACTEC Law Journal, 44, 3-19. https://www.actec.org/

- National Conference of Commissioners on Uniform State Laws. (2003). Uniform Trust Code. Annual Conference Meeting in Its 109th Year, St. Augustine, Florida, July 28-August 4, 2000. https://www.uniformlaws.org/

- National Conference of Commissioners on Uniform State Laws. (2021). Uniform Directed Trust Act. Annual Conference Meeting in Its 126 Year, San Diego, California, July 14-July 20, 2017. https://www.uniformlaws.org/

- O’Hagan, P. (2021). ‘You Say Tomatoes’ – avoiding trustee liability for breach of duties of care in English and US style trust deeds. Trusts & Trustees, 27(3), 175–186. https://doi.org/10.1093/tandt/ttab009

- Schwartzel, B. C. (2021). Was it wise to try to implement trust law reforms through the Uniform Prudent Management of Institutional Funds Act?. Estate Planning & Community Property Law Journal, 14, 179-250. https://epj.us/

- Spica, J. P. (2019). Settlor-authorized fiduciary indifference to trust purposes and the interests of beneficiaries under the Uniform Trust Code. Michigan Probate & Estate Planning, 39, 2-10. https://connect.michbar.org/probate/home

- The Wealth Advisor. (2022). 2021 America’s Most Advisor-Friendly Trust Companies. https://theprivatetrustcompany.com/

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment man- agement fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance.

To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: