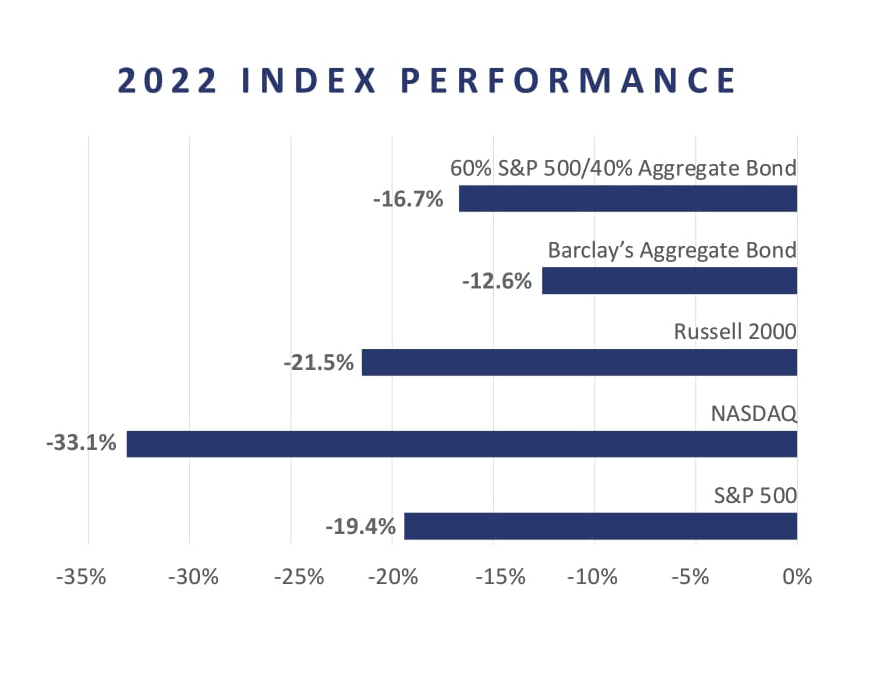

With the year-end now behind us and as we begin to plan and prepare for 2023, it is safe to say that most investors will not look back on 2022 fondly. Capital markets in the US and globally had one of their worst overall years since the 1970s, as both stocks and bonds recorded negative double-digit returns. The S&P 500 index ended the year down nearly 20% and the Barclay’s Aggregate Bond Index finished the year down 12.6%.

The global economy and capital markets were dominated by worries about inflation and the degree to which central banks around the world would need to raise interest rates to get inflation back under control. Inflation and interest rates will likely continue to be dominant economic issues in 2023.

2022 RECAP

One issue that preoccupied markets last year was inflation. The US and most developed economies had been in an extended period of low inflation and low-interest rates since the 1980s. However, two powerful factors in 2022 caused an increase in inflation that had not been seen in 40+ years. The first event was the impact of ultra-low interest rates and exceptional stimulative spending by the US government to combat the impact of Covid disruptions on the economy. The second inflationary catalyst was Russia’s invasion of Ukraine in February of 2022 and the impact that had on the global price of energy and food.

In response to the Covid shutdown that began in early 2020, the Federal Reserve dropped interest rates to near zero, as did many other central banks around the world. Simultaneously, the U.S. Congress passed several spending bills to prop up the economy that injected trillions of dollars into the monetary system. With supply chains interrupted by Covid shutdowns, the result was more money chasing fewer available goods, which is the recipe for inflation. However, the US Federal Reserve believed the resulting inflation would be “transitory.” Early in 2022, they realized their mistake and began to aggressively raise interest rates in an attempt to decrease demand and dampen inflation which had risen to as high as 9.1% in June, 2022 in the US.

The Fed Funds rate (i.e., the short-term rates that major banks pay to borrow from the Federal Reserve) began the year at a range of 0% – 0.25% and ended 2022 at 4.25% – 4.5%. This was one of the fastest and steepest increases in interest rates in US history. The overriding question looking forward to 2023 is whether the Federal Reserve can bring inflation under control without causing a recession, though many economists believe a mild recession in 2023 is likely.

On top of ultra-low interest rates and stimulative spending, Russia’s invasion of Ukraine caused many commodity prices to spike, especially energy and grains, adding further fuel to the inflationary fire.

Interest rate increases received much of the attention last year, but the decline in the money supply was also significant yet less reported. The M2 money supply is the Federal Reserve’s estimate of the total amount of money circulating in the economy. M2 includes cash, checking deposits and non-cash assets that can easily be converted into cash. Typically, the Federal Reserve aims for the M2 money supply to grow at roughly the same pace as the overall economy. But, as a response to the Covid shutdown and stimulative spending, the M2 money supply expanded rapidly in 2020-2022. In February 2020, the estimate of M2 was $15.45 trillion. By March of 2022, it had grown to $21.74 trillion, an increase of nearly 41%. An increase in the money supply that outstripped overall economic growth by such a large margin can be further fuel that ignites inflation.

However, in addition to higher interest rates, the Federal Reserve has also started to shrink the money supply. Between March of 2022 and the end of October, M2 money supply decreased by about 1.5%. We would expect that to continue in 2023.

The US Government and Federal Reserve, as well as central banks and governments in most of the developed world, took extraordinary measures to prop up their economies when Covid hit in early 2020. Their actions not only helped to stimulate the economy but were a key factor underlying strong returns in financial markets in 2020 and 2021. The consequences of those actions resulted in inflation, and appropriate steps are being taken to combat inflation. The increase in interest rates and the decline in the money supply both created the conditions for an extremely poor year in financial markets in 2022. As liquidity drained out of the market, some of the most speculative assets declined the most in value.

2023 OUTLOOK

Looking forward, can investors expect 2023 to be much better for the economy and financial markets? Inflation remains a concern and we believe the Federal Reserve will most likely continue to raise rates during the first part of the year. But there are signs that inflation is slowing. Many commodity prices are down sharply from their highs in the summer of 2022 and the housing market has cooled substantially in some parts of the US. If commodity prices remain low, then the Fed is probably getting closer to the end of its campaign of interest rate increases. The following are factors that investors should monitor for signs of optimism going forward:

End of Interest Rate Increases

The Fed continues to send the message that they are going to continue to raise interest rates until they feel inflation has returned to its long-term goal of about 2%. However, the Fed has already raised rates from a range of 0-.25% at the start of 2022 to 4.25%-4.5% now. They may well raise rates at their first few meetings of 2023, but it is hard to see them raising rates another 4% in 2023.

Softening of Inflation

The most recent inflation numbers released by the U.S. Labor Department in November was a headline year-over-year CPI number of 7.1%, which is down from 9% in June. Core CPI, which excludes food and energy, was 6% in November, down from 6.6% in July. Commodity prices have declined significantly from their peak last summer though job growth, unemployment and wage gains have canceled out much of that decline in the statistics. Although there is still a long way to go, it appears that currently inflation is trending downward in the US.

Repricing of Assets

Much as low-interest rates and stimulative spending propped up the consumer economy, the huge amount of money injected into the economy also stoked a speculative frenzy in parts of the stock market. With bond yields at 1% or lower, stocks were viewed as the only asset class that could generate high returns. Prices were bid up across the market, with the most speculative stocks seeing some of the largest increases. However, with the economy slowing, interest rates increasing, and liquidity being pulled out of the market, many of these highly speculative stocks were down dramatically last year. As we said above, the NASDAQ was down over 33%. But some of the highest flyers of 2020 and 2021 did significantly worse. Tesla is down about 71% since the beginning of 2022. The biggest components of the S&P 500, which drove returns in 2021, have declined significantly since the start of last year: Apple -30%, Alphabet (Google) -39%, Microsoft -32%, and Amazon -50% as of year end 2022. How could this be seen as a positive? With prudent valuations and company fundamentals back in focus, select stocks now have a greater ability to be rewarded by investors, and speculative companies with no earnings will be looked at more skeptically. Virtually the entire stock market was marked down in price by 20%-35%. Valuations should look much more attractive when the economy starts to recover.

China Re-Open

One additional catalyst to monitor is the reopening of China after 3 years of Covid shutdowns. The Chinese government has had some of the most restrictive Covid policies, even after most of the rest of the world had moved beyond country-wide shutdowns. China maintained its zero Covid policies through the end of 2022. However, unrest from the general population, including open protests against draconian shutdowns, quarantines, and testing programs may have finally caused the Chinese government to reassess this policy. As China begins to reopen, its economy could help stimulate global demand and alleviate some inflationary pressures as supply chains become more stable. It is still early in the process and a wave of Covid infections could cause the Chinese government to backtrack on reopening, but the initial signals look positive.

No Tax Increases

With a split Congress resulting from the election in November of 2022, income tax increases are probably off the table for 2023. The same is probably true for significant changes in estate taxes. However, it is important to remember that under current tax laws, the taxable estate threshold will go back down at the end of 2025 as the current law expires. The current taxable threshold is $12.92 million, up from $12.06 million in 2022. The exemption amount is indexed to inflation through the end of 2025. At the end of 2025, the threshold will go down by 50% of whatever the 2025 exemption amount was. The current estimate is that it will be about $6.8 million in 2026. So, although income and estate tax rates probably will not increase in 2023, there is a window over the next three years to do significant estate tax planning before the exemption goes back down.

WHAT TO DO NEXT?

There will be much commentary in the coming months about recessions, inflation, interest rate increases, and the global economy. The US economy may enter a recession in 2023. As we said earlier, interest rate increases could continue in the first part of this year and that will likely continue to bring uncertainty to equity markets. However, volatility and disruptions have historically created some of the greatest opportunities. As we prepare for 2023, here are some of the actions we think you should focus on:

Maintain Asset Allocation Discipline

We strive to build Asset Allocations for the long term. It can be tempting to abandon those long-term strategic allocations when financial markets are volatile. But unless your circumstances or goals have changed dramatically, we know it is best to stay within your long-term allocation targets.

Do Not Panic about Short-Term Volatility

Emotional responses to a declining stock market are natural and understandable. But investment decisions driven by emotion almost always turn out poorly. Recognizing emotions and resisting the urge to make changes out of fear is the first step in avoiding that mistake.

Manage Cash and Keep Adequate Liquidity

Having sufficient liquidity for spending needs for the next 1-2 years is important. Being forced to sell an asset at a depressed price because you need the cash for an expense need should be avoided if possible. Additionally, yields on cash or near-cash investments are now much higher than in the last several years. Many money markets are yielding 4% or more. So, keeping money in cash for liquidity purposes or to take advantage of opportunities is not as punitive as when rates were near zero.

Continue to Diversify, including with Alternative Investments

Over the last ten years, prior to 2022, the performance of US equities, particularly large-cap technology companies, was outstanding. It was easy to think asset allocation did not matter and many people over-invested in these types of names. But 2022 showed the value of diversification, especially with alternative investments that were not specifically invested in public equity and fixed-income markets. We will continue to emphasize this approach for client portfolios.

Look for Opportunities

As Sir John Templeton once said, the best time to invest is when there is blood in the streets. Down markets and economic distress always present new opportunities. We continually look for these opportunities as taking advantage of them might be an important determinant of future investment success.

SUMMARY

Investment returns from public markets, with very few exceptions, were disappointing in 2022. But, since the end of the Global Financial Crisis, the S&P 500 had been up 12 out of the 13 years from 2009-2021. It was inevitable that we would experience a bad year. Volatility may continue in 2023 as the economy works through higher interest rates and developments on inflation. We will continue to help our clients navigate these markets and focus on the long term. Thank you for your continued trust in Bordeaux Wealth Advisors and please contact your advisor if you have any questions or concerns.

Important Disclosures

The material has been gathered from sources believed to be reliable, however BWA cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of Bordeaux’ portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The S&P 500 Index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities. The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The Russell 2000 Index is comprised of 2,000 small-cap companies and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Nasdaq Composite Index is an index of more than 3,700 stocks, weighted by market capitalization. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance, and actual results or developments may differ materially from those discussed. No investor should assume future performance will be profitable or equal the previous reflected performance.

To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. Investment Advisory services are offered through Bordeaux Wealth Advisors, LLC. Advisory services are only offered where Bordeaux and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.

Share: